Production and Distribution of Iron Ore in India

🇮🇳 Distribution of Iron Ore: India

India, though not a top exporter like Australia or Brazil, is self-sufficient in iron ore, with abundant reserves of hematite and magnetite, distributed mainly in the peninsular shield region. Yet, the paradox is: “We have reserves, but we still underutilize them.”

Let’s understand why.

🪨 Geological Foundations: Peninsular Shield = Iron Belt

- India’s iron ore is geologically tied to ancient Dharwarian formations, rich in banded iron formations (BIFs).

- Hematite dominates (~24 billion tonnes), while magnetite (~11.2 billion tonnes) is abundant but largely untapped.

➡️ Stable cratonic geology gives us the reserves—but economic exploitation depends on accessibility, grade, and ecological clearances.

🔴 Hematite: The Workhorse of Indian Steel

- Most abundant and economically viable; constitutes the bulk of domestic production.

- High-grade ores are concentrated in Odisha, Jharkhand, Chhattisgarh, Karnataka, and Goa.

🔹 Top Hematite States (% Share of Reserves):

| State | % Share |

|---|---|

| Odisha | 39 |

| Jharkhand | 20 |

| Chhattisgarh | 19 |

| Karnataka | 12 |

| Goa | 5 |

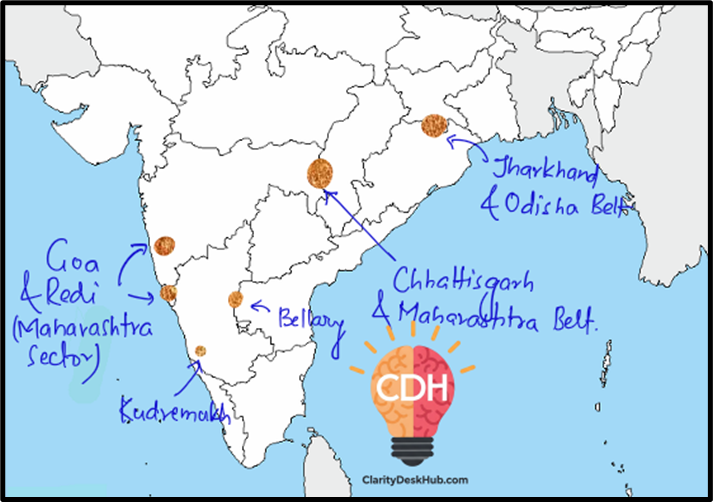

🔹 Major Belts:

- Keonjhar-Barbil (Odisha)

- Singhbhum Belt (Jharkhand)

- Bailadila Hills (Chhattisgarh)

- Bellary-Hospet (Karnataka)

➡️ These are also proximity zones to major steel plants, enabling economic mining.

🧲 Magnetite

- Magnetite is high in iron content, but largely locked in ecologically sensitive zones like the Western Ghats.

- Despite ~11.2 billion tonnes in reserves, extraction is minimal due to environmental regulations.

🔹 Top Magnetite States (% Share):

| State | % Share |

|---|---|

| Karnataka | 70 |

| Andhra Pradesh | 13 |

| Rajasthan | 7 |

| Tamil Nadu | 5 |

| Goa | 2 |

🔹 Major Magnetite Zones:

- Kudremukh, Bababudan (Karnataka)

- Joda-Barbil (Odisha)

- Salem & North Arcot (Tamil Nadu)

➡️ India’s magnetite needs sustainable mining tech to make it viable.

🟡 Limonite & Siderite: Minor but Geologically Important

While not commercially significant, these ores mark the association between coalfields and iron—a geological clue for resource mapping.

🔸 Limonite Distribution:

- Raniganj (WB), Garhwal (UK), Sandur (Karnataka), Kalahandi (Odisha)

🔸 Siderite Distribution:

- Jharia, Bokaro (Jharkhand), Rajhara (Chhattisgarh), Raniganj (WB)

➡️ These are low-grade ores, relevant mainly for academic and geological interest, not commercial mining.

🛠️ 5. Resource Utilization: Explored vs. Untapped

| Category | Hematite | Magnetite |

|---|---|---|

| Total Resource | 24.05 billion t | 11.2 billion t |

| Recoverable Reserve | 6.2 billion t | ~0.2 billion t |

| Unexploitable Resource | 17.8 billion t | 11.0 billion t |

➡️ Most of India’s reserves are untapped due to:

- Low grade

- Lack of technology

- Environmental restrictions

- Transport infrastructure gaps

🏭 Strategic Insight: Steel Plants & Proximity

India’s integrated steel plants (Bhilai, Rourkela, Bokaro, Vijayanagar, etc.) are clustered near iron ore belts, ensuring input cost efficiency.

➡️ This is similar to Germany’s Ruhr Valley or China’s Anshan, where mineral and industrial co-location drives steel output.

✅ Conclusion: India’s Iron Story—Potential > Exploitation

India has enough iron ore to meet its needs, but exploitation is hampered by:

- Ecological challenges (Western Ghats, tribal zones)

- Outdated mining practices

- Focus on export of high-grade ores and import of steel—value addition is missing

➡️ Policy reform + sustainable tech could unlock India’s full iron potential, converting reserves into economic and strategic strength.

Iron Ore Production in India: An Overview

India ranks 4th globally in iron ore production, a significant feat considering the scale of the steel industry and the growing domestic demand. However, despite large-scale domestic production, India is also a net importer of high-grade iron ore, highlighting the complex dynamics between domestic reserves, quality of ore, and steel demand.

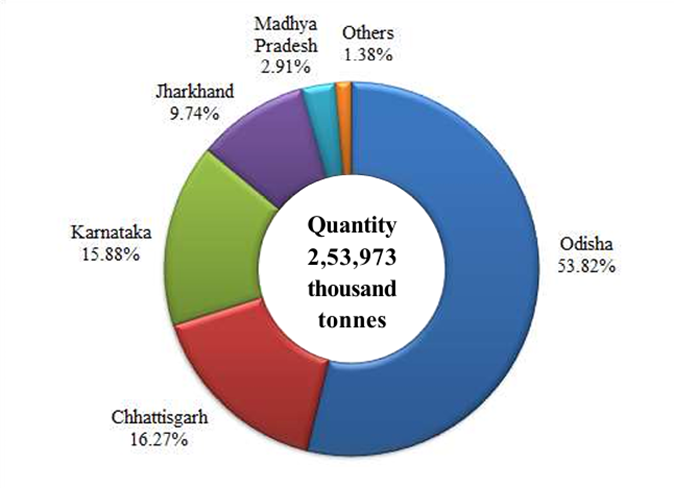

📊 Iron Ore Production Stats (2020-21)

- Total Production: ~205 million tonnes (MT) of iron ore.

- Exports: India exported 26.4 million tonnes (MT).

🏞️ State-wise Iron Ore Production (2020-21)

🪙 Key States and Their Contributions

Odisha

- Rich Hematite Deposits: The Barbil-Koira Valley is the epicenter of iron ore extraction.

- Other Areas: Sundargarh, Mayurbhanj, Cuttack, Sambalpur, Keonjhar, Koraput.

- Odisha’s ores are known for being high-grade hematite, contributing to its dominance in Indian production.

Chhattisgarh

- Bailadila Mines: Known for Asia’s largest mechanized mine.

- Exports: Bailadila ore, being high-grade, is exported via Visakhapatnam Port to Japan and other international markets.

- Smelting: Iron ore is shipped to the Visakhapatnam Iron and Steel Factory for processing.

Jharkhand

- Singhbhum District: Home to India’s earliest mines, producing some of the highest quality iron ore.

- Noamandi Mines: Considered the richest ore deposits in India.

Karnataka

- High-Grade Ore: Karnataka is home to Kemmangundi (magnetite), Sandur and Hospet (hematite) in the Bellary district.

- Magnetite Reserves: Karnataka holds 70% of India’s magnetite ore reserves.

Other States:

- Andhra Pradesh: Located in the Rayalaseema region.

- Maharashtra: Mining areas include Chandrapur, Ratnagiri, Sindhudurg.

- Tamil Nadu: Salem, Tiruchirappalli, Coimbatore, and Madurai.

🌍 Economic Implications of Production

- Global Rank: India is the 4th largest iron ore producer, but it struggles with exporting high-grade ore due to local demand and competition from countries like Brazil and Australia.

- Quality vs. Quantity: Despite vast iron ore reserves, India faces challenges in quality. Domestic steel producers often rely on imported high-grade ores to meet the needs of the steel industry, especially in regions like Chhattisgarh and Odisha.

✅ Conclusion: The Path Forward for India

India’s iron ore production is extensive but inefficient in fully exploiting the available resources, especially low-grade ores. While Odisha and Chhattisgarh lead the way in high-grade ore production, regions like Karnataka face challenges due to competitive pricing and quality concerns.

For India to maintain its position as a global leader in steel production, it needs to:

- Focus on improving beneficiation technologies to use low-grade ores effectively.

- Reduce import dependency through better utilization of domestic resources.

- Encourage sustainable mining practices to balance economic growth with environmental preservation.