Aluminium Industry

Let’s begin with why Aluminium is important.

- If we compare the industrial world to a body, Iron and Steel are like the bones—strong and fundamental. Then, Aluminium is like the nervous system—lightweight, versatile, and essential for modern functions, especially in advanced sectors like aerospace, power distribution, and defense.

- In fact, Aluminium is the second most important metal industry after iron and steel.

It is:

- A good conductor of electricity → Used in power cables and transmission.

- Lightweight yet strong → Used in aircraft, rail coaches, automobiles.

- Corrosion-resistant and recyclable → Used in household items and appliances.

In short, Aluminium is the metal of modernity.

Raw Material: Bauxite

Now, Aluminium doesn’t occur in its pure form in nature. The primary ore from which it is extracted is Bauxite.

Think of Bauxite as raw cotton, and Aluminium as the thread extracted from it—it requires a process to be usable.

Key facts:

- Bauxite is bulky and impure: Hence, refining (removing moisture and impurities) is ideally done close to mining sites.

- 6 tonnes of Bauxite → 2 tonnes of Alumina → 1 tonne of Aluminium

Thus, a huge amount of raw material and power is needed.

Production Process: Two-Step

Understanding the process is like understanding how milk becomes curd and then cheese—each step transforms the material.

Step 1: Refining Bauxite into Alumina

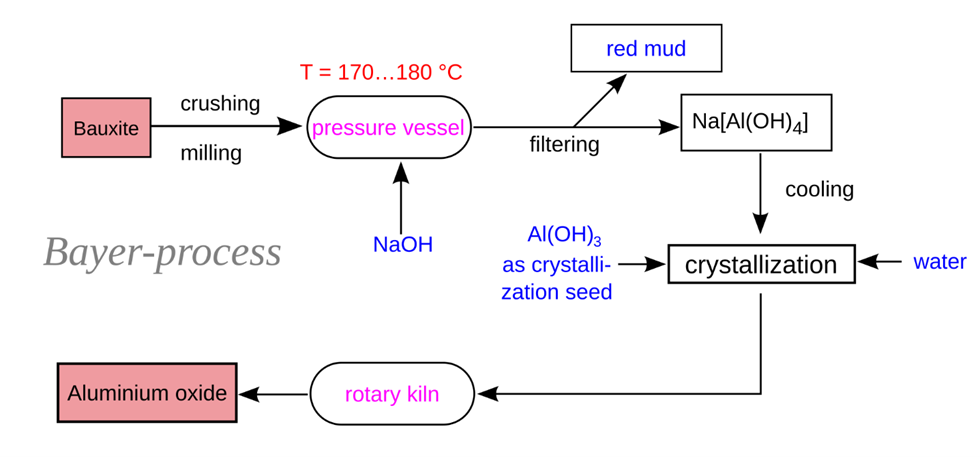

- This uses the Bayer Process.

- Done in alumina refineries.

- Alumina is a white powder, chemically known as Al₂O₃.

Step 2: Smelting Alumina into Aluminium

- Done by the Hall-Héroult Process (electrolysis).

- Requires massive electricity.

- Smelters are located near hydroelectric or thermal power plants.

Hence, Aluminium is often called an “electricity-embedded metal.”

30–35% of Aluminium production cost is electricity.

Upstream vs. Downstream

Industry structure:

- Upstream: Involves mining Bauxite and producing primary Aluminium (raw form).

- Downstream: Further processing into rods, sheets, foils, castings—used in construction, packaging, transport, etc.

So, upstream is the birthplace of Aluminium, downstream is where it grows up and gets a job.

Locational Factors Shaping the Aluminium Industry

“Where an industry is located is never random — it’s a result of geographical compulsion and economic logic.”

The aluminium industry, especially the smelting and refining phase, is extremely resource and energy-intensive. So, its location depends on a variety of physical, economic, and policy-related factors.

Let’s explore each factor systematically:

1️⃣ Raw Material Availability

👉 This is the first and most fundamental factor.

- Aluminium is derived from bauxite, a sedimentary rock.

- So, areas close to bauxite deposits become natural choices for setting up aluminium industries.

📍Examples:

- India – Odisha (Koraput, Kalahandi)

- Australia – Queensland

- Russia – Krasnoyarsk

🌊 Water is also critical, not just for cooling, but for processes like alumina refining. Hence, water-abundant regions are preferred.

🧠 Logic: Proximity to raw material reduces transportation cost and ensures regular supply.

2️⃣ Energy Access

“Aluminium is sometimes called ‘solid electricity’ — that tells you how energy-hungry the process is.”

- Smelting (the process of extracting aluminium from alumina) requires massive amounts of electricity.

- Hence, industries locate near cheap, reliable, and clean energy sources.

📍Example:

- Iceland – Uses geothermal and hydro power, making it a hub for sustainable aluminium smelting.

🧠 Logic: Energy cost can form up to 40% of total production cost in aluminium smelting.

3️⃣ Infrastructure

👉 Aluminium production involves heavy bulk movement:

- Bauxite to alumina refineries

- Alumina to smelters

- Finished aluminium to markets

So, efficient transportation — roads, railways, ports — is vital.

📍Example:

- Eastern coastal India (e.g., Visakhapatnam) benefits from both port access and rail connectivity.

🧠 Logic: Coastal or well-connected regions reduce logistical costs and enhance export potential.

4️⃣ Market Proximity

“Produce where you can sell or where it will be used quickly.”

- Aluminium is widely used in automobiles, construction, aviation, packaging, etc.

- Being close to industrial clusters or urban centres ensures quick delivery and reduced costs.

🧠 Logic: Proximity to users supports just-in-time delivery, reduces warehousing needs.

5️⃣ Labour Availability and Costs

- Though aluminium plants are capital-intensive, they still need a skilled technical workforce.

- Areas with availability of such labour — or where training can be provided cost-effectively — are favoured.

🧠 Logic: Skilled manpower is required for handling electrolysis, refining technologies, and safety systems.

6️⃣ Government Policies

“Geography gives possibilities. Policy makes them profitable.”

- Subsidies on power, tax incentives, land at concessional rates, and special economic zones (SEZs) often attract aluminium industries.

- India’s National Aluminium Policy and schemes under ‘Make in India’ are examples.

🧠 Logic: Government acts as a facilitator by reducing costs and improving ease of doing business.

7️⃣ Environmental Factors

- Aluminium production can cause air and water pollution, red mud waste, and greenhouse gas emissions.

- So, regions with strict environmental norms may either restrict aluminium smelting or push for greener technologies.

- Access to clean energy becomes a competitive advantage.

📍Example:

- Hydro-rich nations like Norway and Canada attract aluminium industries for their clean image.

🧠 Logic: Industries now prefer environmentally sustainable locations to meet ESG norms and global certifications.

Aluminium Production in India

India is the 2nd largest producer of Aluminium globally (as of 2023-24).

Major Bauxite Regions in India:

- Odisha (Kalahandi, Koraput): ~50% of India’s bauxite.

- Jharkhand (Lohardaga, Gumla): Known for high-grade ore.

- Maharashtra (Kolhapur): Rich in alumina content.

- Chhattisgarh (Amarkantak): Supplies BALCO.

- Madhya Pradesh, Andhra Pradesh, Kerala, etc.

These regions are geologically rich, but often economically and infrastructurally backward, which creates a paradox: “resource-rich, but underdeveloped.”

Key Aluminium Companies & Locations

Let’s simplify with a list:

| Location | Company | Notable Info |

|---|---|---|

| Renukoot, UP | HINDALCO | Largest integrated producer |

| Angul, Odisha | NALCO | State-of-art smelter |

| Korba, Chhattisgarh | BALCO | Source: Amarkantak |

| Mettur, TN | MALCO | Uses power from Mettur Dam |

| Alupuram, Kerala | INDAL | First sheet fabrication unit |

Evolution of Aluminium Industry in India

A brief timeline:

- 1937: Aluminium Corporation of India formed.

- 1942: First production at Jay Kay Nagar, West Bengal.

- 1958: HINDALCO begins operations.

- 1965: BALCO and MALCO set up.

- 1981: NALCO established – today among top global players.

Government gave early support via subsidies, tax benefits, and later encouraged private sector participation.

Challenges Faced by the Aluminium Industry

Let’s examine why the industry hasn’t fully realized its potential:

A. Energy Crisis

- Huge electricity demand + high cost = makes production expensive.

- Power cuts or grid dislocation can halt operations.

B. Outdated Technology

- Many plants use old smelting technologies → inefficient.

C. Resource Management

- India has untapped reserves on the east coast.

- Poor infrastructure and bureaucratic hurdles delay their use.

D. Pricing and Profitability

- Government price controls on Aluminium sold to state boards lead to losses.

- Import of essential inputs (like cryolite and fluoride) adds to cost.

E. Market Entry Barriers

- High capital investment

- Long gestation period (~3–4 years to set up a plant like BALCO)

- Control of bauxite mines by existing players

- Scarcity of cheap power

- Complex land acquisition and environmental clearances

F. Labour Issues

- Strikes and unrest also disrupt productivity.

Global Competition

| Rank | Country | Production (approx.) | Key Highlights |

|---|---|---|---|

| 🥇 1 | China | ~40 million tonnes | Dominates with over 55% of global production; benefits from integrated value chain and cheap coal energy. |

| 🥈 2 | India | ~4.1 million tonnes | Strong domestic bauxite reserves; growing renewable push; key producers: Vedanta, Hindalco. |

| 🥉 3 | Russia | ~3.8 million tonnes | Major exporter; Russia is a global giant; facing sanctions and trade redirections. |

| 4 | Canada | ~3.0 million tonnes | Hydro-powered, low-carbon aluminium; key exporter to the U.S. |

| 5 | UAE | ~2.6 million tonnes | Modern plants, heavy investment in technology; Emirates Global Aluminium is a leader. |

| 6 | Australia | ~1.6 million tonnes | Huge bauxite reserves; focus is more on bauxite and alumina exports. |

| 7 | Bahrain | ~1.5 million tonnes | Aluminium Bahrain (ALBA) is a major player; strategic location. |

| 8 | Norway | ~1.3 million tonnes | Hydro-based, low-carbon aluminium; Norsk Hydro is a global sustainability leader. |

Conclusion: The Road Ahead

“Aluminium Industry is the symbol of India’s untapped industrial promise. We have the resource, we have the demand, and we have the global opportunity. But, like a talented student with distractions, the industry suffers from systemic inefficiencies—power issues, outdated tools, bureaucratic exams, and high tuition fees. If these can be overcome, India can be the ‘flying metal capital’ of the world, quite literally.”