World Energy Outlook Report 2025

Source: International Energy Agency (IEA), World Energy Outlook 2025

International Energy Agency (IEA)

- The IEA, an autonomous intergovernmental organisation, analyses data on energy use and requirements and provides policy recommendations and solutions to countries for sustainable energy growth.

- The IEA’s World Energy Outlook report, published annually, captures the world’s energy trends and transitions and predicts future trajectories.

World Energy Outlook Report 2025

Energy security in a volatile world

Why energy has become a national security issue

- Energy security now extends beyond oil & gas to include:

- Critical minerals (lithium, cobalt, rare earths)

- Electricity grids (cyber risks, weather shocks)

- Energy disruptions affect → Economic stability, Defence systems, Digital infrastructure (AI, data centres)

Present global contradictions

- Geopolitical instability exists alongside:

- Oil market surplus

- Subdued oil prices

- Countries adopt divergent strategies:

- Import-dependent nations → renewables & efficiency

- Resource-rich nations → traditional fuel security

📌 UPSC Angle:

Energy security is no longer just “fuel availability” → it is geopolitics + technology + supply chains.

Climate action losing momentum, risks rising

- 2024:

- Hottest year on record

- First year with global temperature >1.5°C above pre-industrial

- Despite this:

- Slower momentum on emissions reduction

- Weakening of international commitments

📌 UPSC Insight:

Mismatch between climate urgency and policy action → fertile ground for GS-III & Essay questions.

Global energy demand: still rising

- Renewables added at record pace (23rd consecutive year)

- Yet all fuels hit record highs: Oil, Natural gas, Coal, Nuclear

- Since 2019:

- Coal demand grew 50% faster than gas, mainly due to China

- Result:

- Energy-related emissions continue to rise

WEO scenario framework

Core Scenarios in WEO-2025

| Scenario | Meaning |

|---|---|

| CPS | Current Policies Scenario – only existing policies |

| STEPS | Stated Policies Scenario – includes announced but not fully implemented policies |

| NZE | Net Zero Emissions by 2050 – normative pathway |

| ACCESS | Universal electricity & clean cooking access |

📌 Note:

WEO scenarios are not forecasts, but decision-pathway tools.

Common Findings Across All Scenarios

Four structural shifts

- Energy security now depends on critical minerals

- Arrival of the “Age of Electricity”

- Shift in demand centre to India & emerging economies

- Rising role of renewables + comeback of nuclear

Critical Minerals: The New Energy Vulnerability

Key facts

- One country dominates refining of 19 out of 20 strategic energy minerals

- Average refining market share: ~70%

- Minerals critical for:

- EVs, batteries, power grids

- AI chips, defence systems, jet engines

- >50% of strategic minerals subject to export controls (as of Nov 2025)

Policy implication

- Market forces alone cannot diversify supply

- Requires:

- Strategic stockpiles

- New international partnerships

- Domestic processing capacity

📌 UPSC Link:

Critical minerals = Energy security + Strategic autonomy (India context).

Infrastructure Resilience & Climate Risks

- Energy disruptions affected 200 million households annually

- Causes:

- Droughts → hydropower & thermal output loss

- Floods, storms, wildfires → plant shutdowns

- 85% of incidents involved transmission & distribution grids

- All scenarios exceed 1.5°C by ~2030, diverging only after 2035

The Age of Electricity

Electricity demand growth

- CPS & STEPS: +40% by 2035

- NZE: +50% by 2035

Demand drivers

- Cooling (ACs)

- Electric mobility

- Data centres & AI

- Electrified heating & manufacturing

Investment trends

- Electricity supply + electrification = 50% of global energy investment

- Annual electricity generation investment: ~USD 1 trillion

- Grid investment: ~USD 400 billion (lagging badly)

📌 UPSC Insight:

Generation without grids → congestion, curtailment, blackouts.

Data Centres, AI & Energy

- Electricity use by data centres:

- Expected to triple by 2035

- Investment in data centres (2025):

- USD 580 billion (higher than oil supply investment)

- Concentration:

- USA, China, EU (>85% of additions)

- Strains already congested grids

Shift in Global Energy Demand Geography

- Post-China phase:

- Growth led by India, Southeast Asia, parts of Africa & Latin America

- By 2035:

- 80% of energy demand growth in high-solar-irradiation regions

- Explains:

- Rapid solar uptake

- Rising cooling demand

Renewables: Continued Rise

- Renewables grow fastest in all scenarios

- Solar PV leads

- China:

- 45–60% of global RE deployment

- Dominant manufacturer of solar panels & batteries

- Global surplus:

- Solar manufacturing capacity > 2× deployment

- Battery capacity ~3× deployment

📌 UPSC Angle:

China’s dominance → opportunity for affordability + concern for supply dependence.

Nuclear Power Comeback

- Nuclear included in strategies of 40+ countries

- >70 GW under construction (highest in 30 years)

- SMRs emerging:

- ~30 GW interest, mainly for data centres

- Global nuclear capacity to increase ~33% by 2035

Diverging Pathways for Fossil Fuels

Coal

- Future written in Asia

- STEPS & NZE → steady decline

- CPS → slower decline due to grid constraints

Oil

- Near-term surplus

- CPS requires 25 mb/d new supply by 2035

- EVs:

- 25% of new car sales in 2025

- 50% by 2035 (STEPS)

Natural Gas & LNG

- 300 bcm new LNG capacity by 2030

- US (~50%), Qatar (~20%)

- Likely LNG overhang (~65 bcm) in 2030

- India & South Asia absorb part due to affordability

Energy Access: A Development Priority

- 730 million people without electricity

- ~2 billion without clean cooking

- ACCESS Scenario:

- Universal electricity by 2035

- Clean cooking by 2040

- LPG main transition fuel for cooking

- ~80 million people/year gain electricity access to 2035

Emissions & Climate Outlook

- Energy-related CO₂ emissions (2024): 38 Gt (record)

- CPS → ~3°C warming by 2100

- STEPS → ~2.5°C

- NZE:

- 1.5°C overshoot inevitable

- Return below 1.5°C by 2100 via:

- Rapid transition

- Large-scale CO₂ removal (unproven)

Policy Options to Cut Emissions

- Scale-up renewables & nuclear

- Improve energy efficiency

- Reduce methane leaks

- Electrify end-use sectors

- Use hydrogen & CCUS where electrification is hard

- COP28 target:

- Tripling renewables by 2030

- Efficiency improvement target (4%) not met (currently ~2%)

UPSC Insights

- Energy security = fuel + minerals + grids + climate

- India emerges as future demand centre

- Electricity is the backbone of future energy systems

- Renewables dominate growth, but fossil fuels persist

- Grid investment & mineral diversification are decisive bottlenecks

- Policy choices today shape security, affordability & climate outcomes

India – Energy Outlook (WEO 2025)

India as the Global Engine of Energy Demand Growth

- India is the largest source of energy demand growth globally in the Outlook.

- In the STEPS (Stated Policies Scenario):

- Energy demand increases by >15 exajoules (EJ) by 2035

- This is almost equal to China + all Southeast Asia combined

- India’s contribution to global growth (to 2035):

- 1st in oil demand growth

- 2nd in electricity generation growth

- 2nd in coal demand growth

- 3rd in natural gas demand growth

📌 UPSC relevance:

India is no longer a marginal player but a system-shaping country in global energy markets.

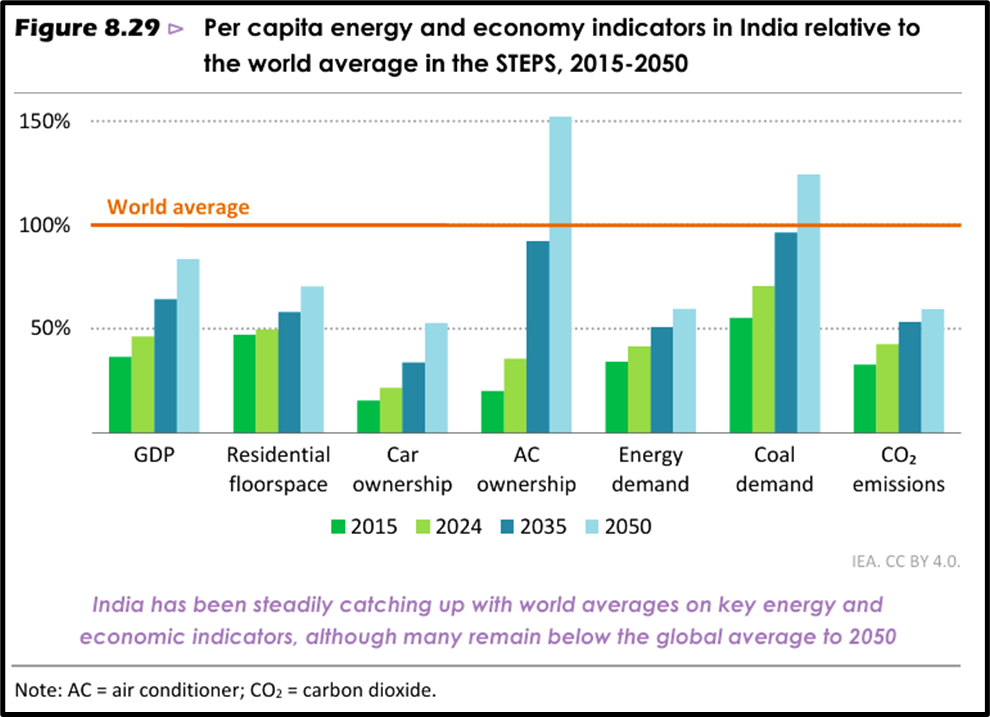

Economic & Demographic Drivers of Energy Demand

Growth fundamentals

- GDP growth (2010–2024): Second only to China

- Projected GDP growth (to 2035): 6.1% annually (highest among major economies)

- GDP per capita in 2035: ~75% higher than today

Structural transformation

- Urbanisation:

- India adds one Bangalore every year to its urban population (till 2035)

- Built environment:

- Floor space expands by 40%

- Mobility:

- ~12,000 cars added every day

- Cooling demand:

- >250 million air conditioners added over the next decade

📌 Insight:

India’s energy transition is driven not by luxury consumption but by basic development needs.

India’s Multiple Energy Challenges

India must simultaneously address:

- Universal access to modern energy

- Reduction in fossil-fuel import dependence

- Reliability of electricity supply

- Air pollution reduction

- Greenhouse gas (GHG) mitigation

Energy access

- Despite progress, ~20% of population still relies partly or fully on traditional biomass for cooking

- Pradhan Mantri Ujjwala Yojana:

- LPG subsidies for poor households

- Key clean-cooking intervention

Climate Commitments & Policy Direction

- Net Zero target: 2070

- Supporting measures:

- 50% non-fossil power capacity target by 2030

- Nuclear expansion to 100 GW by 2047 (from ~8 GW today)

- Carbon market for select industries from 2026

- Biofuels policy:

- 20% ethanol blending in petrol achieved in 2025

- Aimed at reducing oil imports

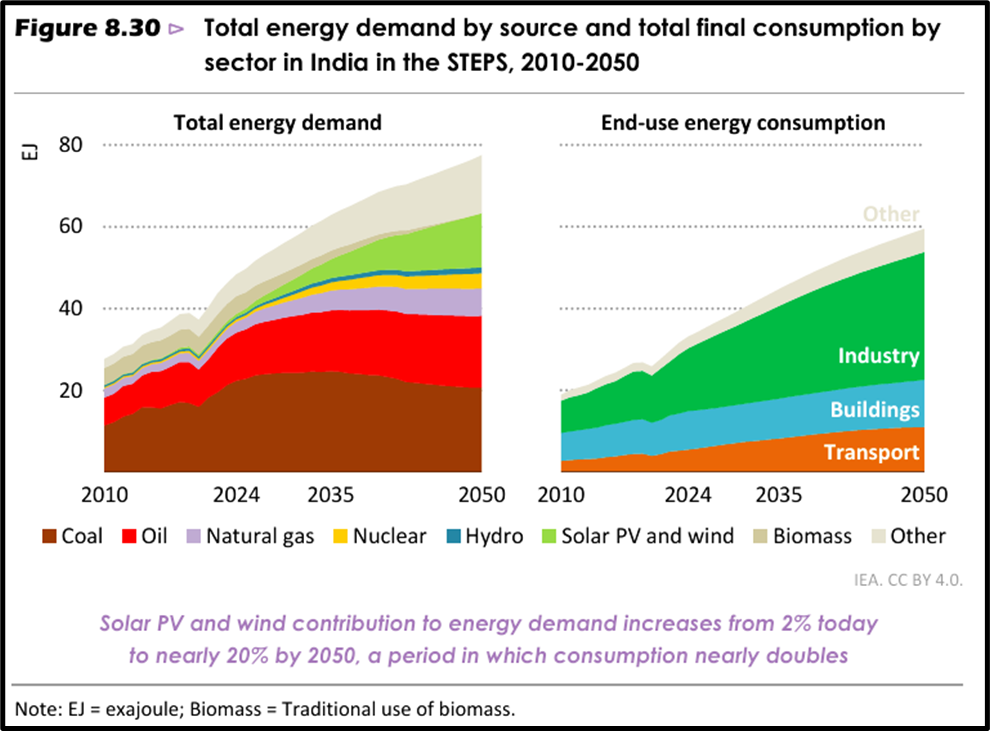

India’s Energy Mix in the STEPS

Long-term trends

- Solar PV and wind are the fastest-growing energy sources to 2050

- Together they reach ~20% of India’s total energy mix

- Coal and oil remain mainstays, especially for → Industry, Dispatchable power

Sectoral demand growth

- Fastest growth → Industry, Transport

- Industry alone accounts for >50% of demand increase by 2050

Emissions trajectory

- CO₂ emissions:

- Peak around 2040

- ~3.4 Gt per year by 2050 (STEPS)

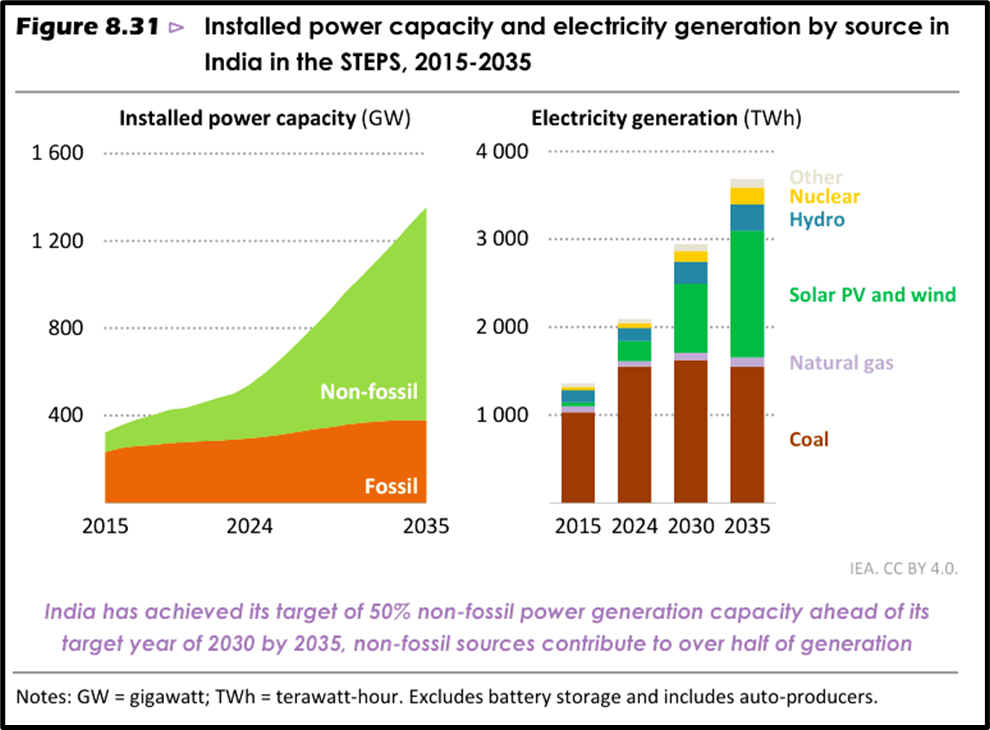

India Achieves 50% Non-Fossil Power Capacity Ahead of Time

- Target announced in 2022:

→ 50% non-fossil power capacity by 2030 - Achieved in 2025 for grid-connected capacity

- Achieved in 2026 even after including auto-producers

Investment shift (very important)

- 2015: Fossil : Non-fossil = 1 : 1

- 2025: Fossil : Non-fossil = 1 : 4

- Solar PV investment (last decade):

- USD 113 billion

- More than all fossil fuel power generation combined

📌 UPSC Insight:

India’s transition is investment-driven, not merely target-driven.

Future Power Mix (STEPS)

Installed capacity

- Non-fossil share:

- 60% by 2030

- 70% by 2035

- >95% of capacity additions to 2035 are non-fossil

Electricity generation

- Solar + wind:

- 11% today → >25% by 2030 → ~40% by 2035

- Nuclear:

- Generation triples by 2035

- Non-fossil sources:

- >50% of electricity generation by 2035

Carbon intensity

- Falls by ~45%

- To ~400 g CO₂/kWh

- Narrows gap with global average

Co-benefits

- Sharp reduction in:

- Fine particulate matter (PM)

- Sulphur dioxide (SO₂)

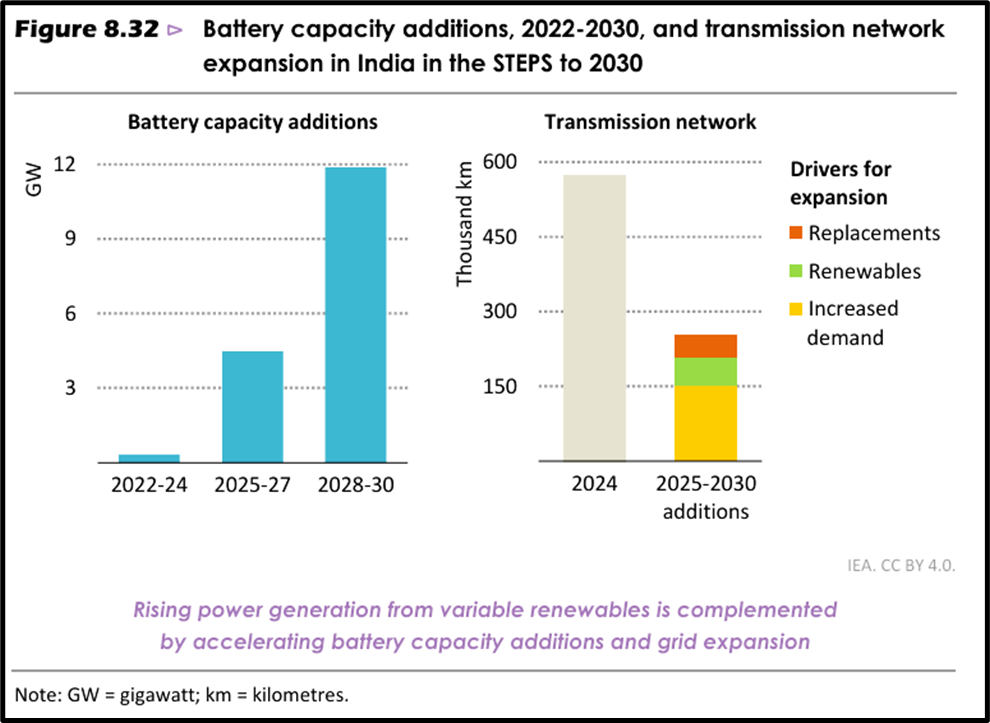

Grid, Storage & System Flexibility Challenges

Storage

- >230 GWh of battery storage added by 2030 (STEPS)

- Government issuing tenders for new storage capacity

Transmission

- Network expands by 35% by 2030

- >200,000 km of new transmission lines

- ~60,000 km specifically for renewable integration

- Green Energy Corridor → Backbone for renewable evacuation

📌 Conceptual takeaway:

Renewable transition = Generation + Storage + Grids, not generation alone.

Financial Stress in Power Distribution

- Distribution companies (DISCOMs) face:

- Delayed payments of ~USD 7 billion (Oct 2025)

- Reforms undertaken:

- Payment security mechanism

- Payment security fund

- State government guarantees

Impact

- Foreign Direct Investment (FDI) in power sector:

- Doubled to ~10% of total power investment

- Compared to average during 2015–2020

UPSC Insights

- India is the single most important driver of future global energy demand

- Energy transition in India is shaped by development needs, not luxury consumption

- Achieving 50% non-fossil capacity early is a landmark but:

- Coal remains important for reliability

- Grid expansion, storage, and DISCOM reforms are critical bottlenecks

- India’s pathway shows how growth, energy security, and climate action can be pursued together