Cement Industry

Imagine a building without cement. Not possible, right?

Cement is the glue that binds our infrastructure—homes, roads, bridges, dams. That’s why it is classified as a core industry, meaning it’s essential for economic development.

The presence of a strong cement industry shows two things:

- Construction is happening → implies development

- People can afford to build → implies prosperity

That’s why even per capita cement consumption is seen as an index of economic well-being.

📊 Key Fact:

- India’s per capita consumption: ~240-250 kg

- World average: ~500-550 kg

(As of 2024)

This shows that while we’ve made progress, we still have immense scope for growth.

🏭 Nature of the Industry: Advanced but Raw-Material Oriented

The cement industry is one of India’s most advanced, due to:

- Use of modern technology

- High efficiency of Indian plants

- Low production cost

But despite being advanced, it is raw material-oriented. Why? Let’s explore

🏗️ Manufacturing of Cement

Raw Materials

- Calcareous (lime-rich): limestone, marl, chalk, cement rock.

- Argillaceous (clay-rich): clay, shale, slate, blast furnace slag.

- Choice of raw material determines process suitability.

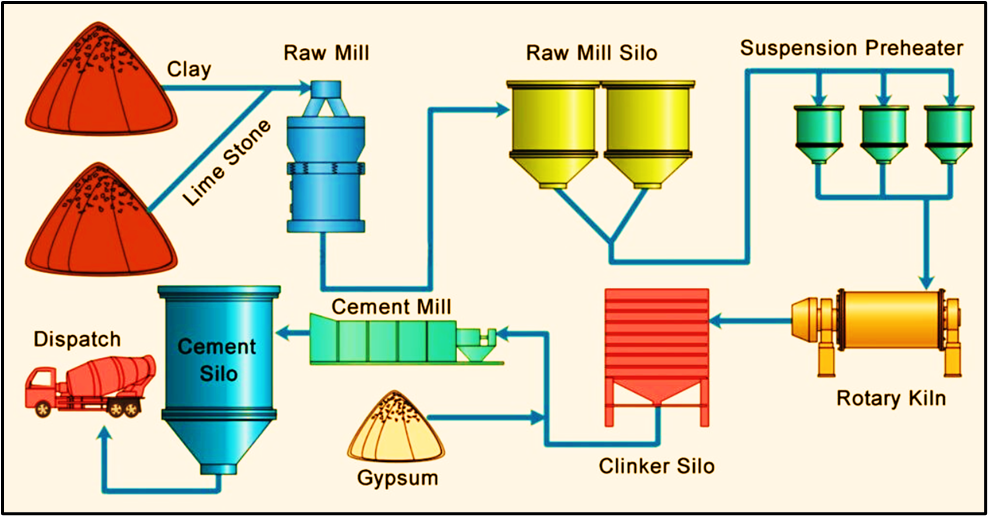

Processes of Manufacture

Two main methods: Dry Process & Wet Process.

🔹 Dry Process

- Preferred when raw materials are hard.

- Steps:

- Crushing → dry mixing.

- Add ~14% water → cohesion → lumps.

- Feed lumps into rotary kiln → calcination → clinkers formed.

- Clinkers cooled → ground in tube mills.

- Add 2–3% gypsum → retard setting.

- Final product: Ordinary Portland Cement (OPC).

🔹 Wet Process

- Suitable when raw materials are soft.

- Steps:

- Crushing + water → slurry in wash mill.

- Pulverization with steel balls.

- Slurry composition adjusted in silos (~40% moisture).

- Sent to rotary kiln → heated to 1500–1600°C → clinkers formed.

- Clinkers cooled → ground in tube mills.

- Add gypsum → final cement powder.

Key Reactions

- Calcination in kiln:

- Removal of volatiles.

- Oxidation → formation of clinkers.

- Role of gypsum: controls setting time by coating cement particles.

Comparative Insights

| Aspect | Dry Process | Wet Process |

|---|---|---|

| Raw material type | Hard | Soft |

| Energy requirement | Lower | Higher (due to slurry evaporation) |

| Cost | Cheaper | Costlier |

| Homogeneity control | Less | Better (slurry allows proportioning) |

🗺️ Locational Factors: The Geographical Logic

Raw Materials – Especially Limestone

- Cement production typically requires:

- 60–65% limestone

- 20–25% silica

- 5–12% alumina

- Small amounts of gypsum, slag, sea shells

- For every 1 tonne of cement → 1.5 tonnes of limestone is needed.

Hence, the ideal location for a cement plant is:

Near limestone deposits, especially where it’s high quality and abundant.

That’s why we see cement plants along the Vindhyan ranges—Eastern Rajasthan to Jharkhand.

⚡ Energy (Coal + Electricity)

- Energy forms ~40% of production cost

- Used in:

- Grinding raw material

- Running kilns (coal as fuel and heat source)

Thus, power availability is crucial.

🚚 Transportation

- Cement is a heavy, low-cost item.

- Transporting it over long distances makes it expensive.

Hence, there are two key location strategies:

- Near raw material source (to avoid transporting limestone)

- Near markets (to avoid transporting cement itself)

Sometimes a middle ground is chosen, balancing both.

🏙️ Market Access

A ready market is essential for such a bulky commodity.

- Urban areas

- Industrial zones

- Infrastructure corridors

Without market access, even a well-placed plant will struggle to survive.

🌍 Regional Pattern

- Vindhyan belt (Rajasthan → MP → Chhattisgarh → Jharkhand): high limestone, dense cement clusters

- Northern plains (Punjab, Haryana, UP): lack limestone → less cement industry

📈 Growth of Cement Industry: From Deficiency to Global Leadership

Let’s take a historical look:

🔁 Pre-1980s: Scarcity and Control

- Cement was under price and production control

- Demand outpaced supply

- Black marketing was common

📉 Partial Decontrol in 1982:

- Industry was freed partially from price controls

- Suddenly, production boomed

- India became self-sufficient in cement within 5 years

🚀 Post-Liberalization Growth:

- Technology upgraded

- Capacity expanded

- Many mini plants emerged to tap scattered deposits

- India became 2nd largest producer (after China)

🧪 Mini Cement Plants: Small but Strategic

Why were mini plants promoted?

- Limestone deposits are often scattered in remote areas

- Building a large plant there is economically unviable

- So, the government encouraged mini plants with incentives like:

- 50% reduction in excise duty

- Supportive infrastructure in rural zones

Benefits:

- Brings employment to remote regions

- Makes cement affordable and accessible locally

🛠️ Major Government Programmes Driving Demand

To utilize the excess capacity in cement production, the government launched:

- 🏠 Housing for All

- 🛣️ PMGSY (Grameen Sadak Yojana)

- 🚘 Four-lane highway development (Golden Quadrilateral, Bharat Mala)

These massive infrastructure projects provide sustained demand for cement.

⚠️ Problems Faced by the Industry

Despite all this, challenges remain:

🚛 Inadequate Transportation

- Roads and railways not always efficient for bulk material

- High logistics cost

🔋 Shortage of Power

- Especially in rural regions or peak demand seasons

🏭 Shortage of Coal

- Coal is needed not just for fuel but also to fire limestone kilns

- Often diverted to power sector or affected by poor mining logistics

📉 Low Per Capita Consumption

- Despite growth, India’s per capita use is much below global average

Indicates untapped potential—especially in rural housing and infrastructure.

🧩 Conclusion: Cementing the Foundation of India’s Development

To conclude:

If steel is the skeleton of infrastructure, cement is the muscle that gives it strength.

The Cement Industry of India today is:

- Technologically advanced

- Globally competitive

- Resource-dependent

- Yet full of untapped potential

With sustained infrastructure growth, rural development, and better power/logistics, this industry can not only grow further, but also raise India’s per capita consumption, employment, and export capacity.