Fetter’s Law of Industrial Location – (1924)

👨🏫 Who was Frank A. Fetter?

Frank A. Fetter was an American economist who proposed this law in 1924. His contribution is often seen as a bridge between earlier cost-based theories like Weber’s and the more market-focused ones like Lösch’s.

He made a key realization:

“Industries locate not just where cost is low, but where maximum profit can be earned.”

So, his theory combines cost minimization and revenue potential in a very logical way.

💡 Core Idea of Fetter’s Law

Let’s understand the essence:

🔑 “The place of minimum cost is the place of maximum profit.”

This is the heart of Fetter’s law.

In simple terms:

Wherever the cost of production and transport is lowest, that is exactly where the profit will be highest, and hence the ideal location for industry.

But remember—this model works assuming that demand exists everywhere (i.e., markets have unlimited demand).

This means → If you set up a factory at a profit-maximizing spot, your product will be sold, because demand will adjust to it.

🗺️ Fetter’s Location Scenarios

Fetter took various hypothetical situations and showed how industries will behave in each. Let’s understand them:

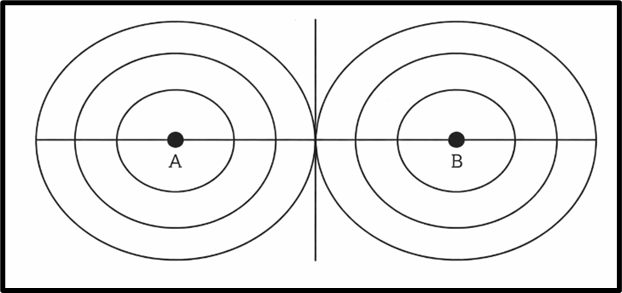

🧮 Case 1: Equal production and transport cost at two centres

Suppose there are two centres, say A and B, and both have:

- Same production cost, and

- Same transport cost to surrounding markets.

🧭 Then where will the industry be located?

✅ The industry will locate anywhere along the center line between A and B, because cost and profit are the same at any point along that line.

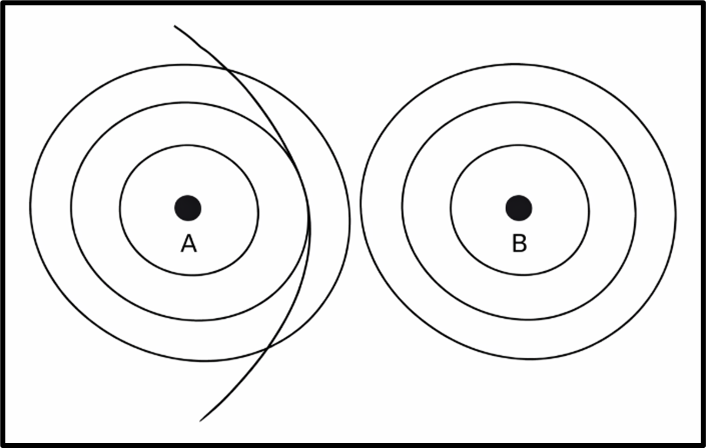

🧮 Case 2: Production cost is higher at one centre

Let’s say:

- Production cost at A is less than at B.

- Transport cost is still the same at both.

📌 Then what happens?

✅ The boundary of market for the industry shifts toward B, because B becomes less competitive due to higher cost.

👉 So industries will prefer being closer to A, the cheaper production centre.

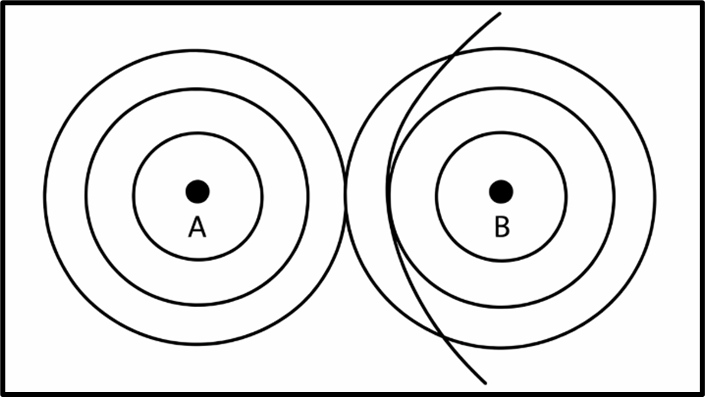

🧮 Case 3: Same production cost, but transport cost is higher at one centre

Assume:

- Both centres have same production cost.

- But B has higher transport cost than A.

📌 What’s the result?

✅ Again, the boundary shifts toward B, because its total cost becomes higher, making A a more attractive location.

This demonstrates a very logical principle:

Even small differences in cost—whether production or transportation—can shift industrial preference.

🔁 Further Developments

Fetter’s ideas were further built upon by other economists:

🧠 Palander (1953)

- Palander added the element of competition.

- He explained how multiple firms compete for the same market.

- He introduced market boundary lines and how they shift depending on price, cost, and location.

🧠 Greenhut (1956)

- Greenhut emphasized the interdependence between:

- Minimum cost

- Localization of industries

- He said that firms don’t just look at their own costs, but also react to the location decisions of others—bringing in the idea of spatial competition.

🎯 Why is Fetter’s Law important?

- Bridge Theory – Connects cost-based and revenue-based approaches.

- Foundation of Spatial Economics – Many modern spatial competition models derive their logic from Fetter’s principle.

- Relevance to Policy – Helps explain why industries concentrate around low-cost zones (like SEZs, tax-havens, or cheap-labour states).